Unraveling the Mystery: Who Qualifies for the Employee Retention Credit? Can Be Fun For Everyone

A Manual to Establishing Your Eligibility for the Employee Retention Credit

The Employee Retention Credit (ERC) is a beneficial tax obligation credit score accessible to companies that have been affected through the COVID-19 pandemic. It was offered as part of the CARES Act in 2020 and has been extended and expanded under succeeding legislation. The ERC is made to aid companies maintain their workers on pay-roll throughout these demanding times.

Calculating your qualification for the Employee Retention Credit is important if you prefer to take conveniences of this important tax reward. In this guide, we will certainly walk you with the key standards that require to be fulfilled in purchase to qualify for the credit history.

Initially and foremost, it's vital to note that there are two different qualifications time periods for the ERC: 2020 and 2021. The policies and requirements might vary relying on which year you are considering.

For 2020, entitled companies include those who experienced either a full or limited suspension of functions due to authorities orders related to COVID-19. This could possibly include companies that were mandated to close or substantially minimize their operations throughout particular time frames of time. Also, companies who experienced a considerable downtrend in gross proof of purchases matched up to the exact same one-fourth in 2019 might also be eligible for the credit report.

To find out if your organization complies with the disgusting vouchers decline exam, you need to have to review your quarterly gross invoices from 2020 versus those coming from the equivalent quarter in 2019. If your disgusting vouchers have dropped through more than 50%, you fulfill this demand.

For qualified companies along with even more than 100 full-time workers, only wages paid for to workers who were not providing companies throughout a period of closure or lessened procedures qualify for the credit. On Claiming the employee retention tax credit , for entitled employers along with a lot less than 100 full-time employees, all earnings paid out during the course of a period of closure or lowered procedures can easily be thought about for figuring out the credit score.

Moving on to eligibility criteria for 2021, the criteria have been slightly tweaked. Companies can now certify for the credit if they experienced a decrease in gross invoices of 20% or even more compared to the very same fourth in 2019. In addition, companies who were topic to a complete or limited suspension of procedures due to federal government orders are still eligible.

It's worth taking note that there are specific constraints on declaring the Employee Retention Credit. For example, wages used to determine various other COVID-19 alleviation plans like PPP lendings cannot be made use of for figuring out this credit rating. Furthermore, the complete quantity of qualified wages taken into profile for each employee cannot surpass $10,000 per one-fourth.

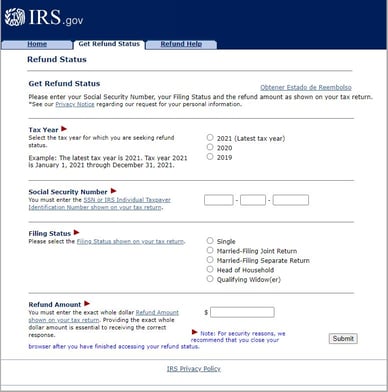

To claim the Employee Retention Credit, qualified companies require to mention their qualified earnings and similar quantities on their federal government work tax obligation returns (normally Form 941). It's important to maintain precise records and documents to assist your case in instance of an audit.

If you're unpredictable about your qualifications or how to appropriately work out and declare the credit score, it's suggested to look for assistance from a qualified tax expert or consult with along with the IRS straight.

In verdict, finding out your qualifications for the Employee Retention Credit is crucial if you want to take conveniences of this important tax incentive. The standards may vary relying on whether you're thinking about 2020 or 2021, but commonly consist of elements such as disgusting proof of purchases decline and suspension of procedures due to authorities purchases. Maintain in mind that there are actually limitations on stating the credit scores and effective record-keeping is crucial. Through understanding these demands and seeking qualified insight when required, you can easily make certain that you make best use of your advantages from this essential plan.

Note: Word count - 583 words